Introduction

One of the prime decision-points, facing start-ups and established business executives, is the creation of a strategy to successfully position their business products and services within an existing competitive industry! The best practice technique to determine the state of a targeted competitive environment is Porter’s Five Forces Framework. A Framework is a widely-recognized tool for identifying and evaluating the five forces that are recognized to discover the competitive intensity and attractiveness (or lack of it) and determine whether a business can be profitable based on the profiles of similar industry organizations.

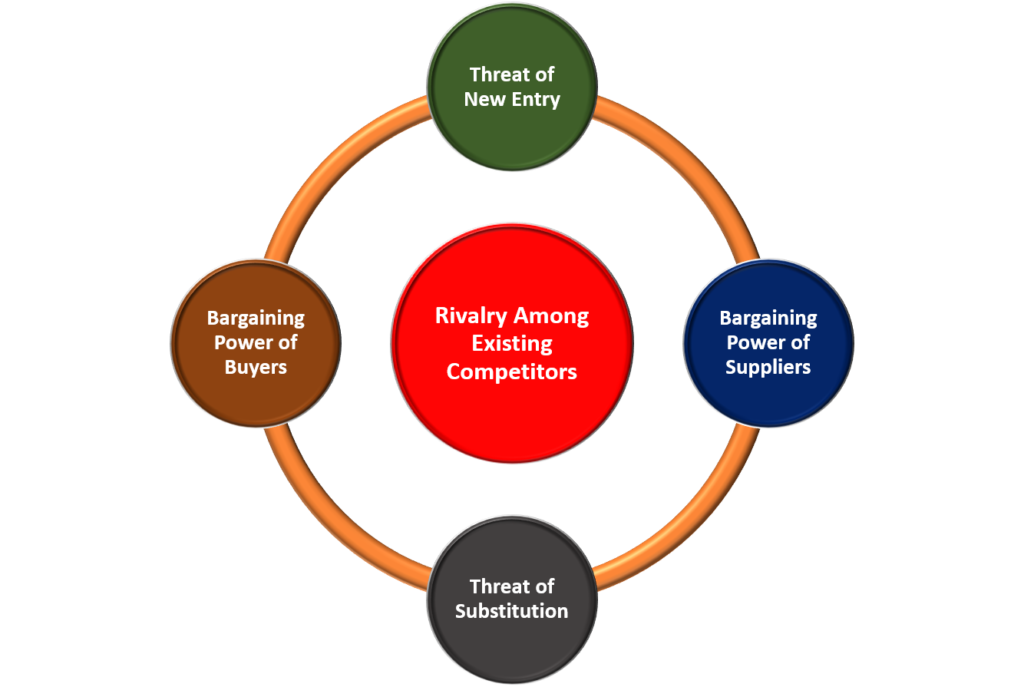

The Five Forces Framework encompasses:

Force 1: Threat of New Entry

Act as a deterrent against new competitors.

Force 2: Bargaining Power of Buyers

Influential buyers have a significant impact on prices.

Force 3: Threat of Substitution

The availability of substitute products will limit the ability to raise prices.

Force 4: Bargaining Power of Suppliers

Powerful suppliers can demand premium prices and limit profits.

Force 5: Rivalry Among Existing Competitors

Intense competition leads to reduced profit potential for companies in the same industry.

Michael Porter & Five Forces Concept

In 1979, Michael Porter, an associate professor at Harvard Business School, published his first article for HBR, “How Competitive Forces Shape Strategy.” In the years that followed, Porter’s explication of the five forces that determine the long-run profitability of any industry has shaped a generation of academic research and business practice. Porter, in his articles, undertakes a thorough reaffirmation and extension of his classic work of strategy formulation, including substantial new sections.

According to Porter, the source of business profitability is identical regardless of industry. Therefore, Porter viewed industry structure as what ultimately drives competition and profitability!

Strategic analysts use the Five Forces to understand whether new products or services are potentially profitable in a targeted industry. By understanding where economic power lies, the Five Forces data can also be used to identify areas of company strength and opportunities to leverage and weaknesses and threats to eliminate and mitigate to avoid bad strategic decision-making.

“The thing is, continuity of strategic direction and continuous improvement in how you do things are absolutely consistent with each other. In fact, they’re mutually reinforcing.”

Michael Porter

An Attractive Industry Profile

According to Michael Porter’s Five Forces, an attractive industry has the following characteristics.

- The threat of new entrants is low.

- The bargaining power of suppliers is weak.

- The bargaining power of buyers is weak.

- The threat of substitute products is low.

- The intensity of rivalry among industry competitors is low.

- Complementary products or services are unavailable.

Understanding the Five Forces

Force 1: Threat of New Entry

The threat of new entry determines how easy (or not) it is to enter a targeted industry. If an enterprise is viewed as profitable with few barriers to enter, competition soon strengthens. When more businesses compete for the same market share, profits will ultimately decrease. It is mission-critical for existing industry participants to create high barriers for entry to deter new entrants.

The key factors typically associated with the use of the Threat of New Entry Force encompass:

- Access to suppliers and distributors.

- Brand reputation.

- Capital required.

- Economies of scale.

- Government regulation.

- Legal barriers.

- Product unique differentiation.

- Retaliation by current industry businesses.

- Infrastructure costs.

Force 2: Bargaining Power of Buyers

The bargaining power of buyers is the ultimate power to demand lower prices or higher product quality from industry suppliers when their bargaining power is reliable. Lower prices mean lower revenues for suppliers, while more top quality products usually raise production costs.

The key factors typically associated with the use of the Bargaining Power of Buyers Force cover:

- Buyer size and capital.

- Cost of switching suppliers.

- Current and potential buyers.

- Order and wallet size.

- Potential and real product substitutes.

- Price sensitivity.

- The threat of integrating backward.

Force 3: Threat of Substitution

The threat of substitution is especially menacing when buyers can easily find substitute products with attractive prices or better quality, and when buyers can switch from one product or service to another with little cost.

The key factors typically associated with the use of the Threat of Substitution Force include:

- Competitors’ size and capital.

- Cost of industry exit.

- Customer loyalty.

- Industry: growth rate and size, current and projected.

- Competitors in the targeted industry.

- Product unique differentiation.

- The threat of horizontal integration.

- Level of advertising expense.

Force 4: Bargaining Power of Suppliers

The bargaining power of suppliers allows suppliers to sell higher priced or low-quality raw materials to corporate buyers.

The key factors typically associated with the use of the Bargaining Power of Suppliers Force include:

- Ability to source substitute materials.

- Switch cost to alternative product materials.

- Materials scarcity.

- Suppliers in the targeted industry.

- Suppliers size and capital.

- The threat of integrating forward.

Force 5: Rivalry Among Existing Competitors

Competitive rivalry is the primary determinant of competitive and profitable. In a competitive industry, businesses must compete aggressively for market share.

The key factors typically associated with the use of the Rivalry Among Existing Competitors Force are outlined below:

- The number of competitors in the targeted industry.

- Cost of industry exit.

- Industry growth rate and size.

- Product unique differentiation.

- Competitors size and capital.

- Customer loyalty.

- The threat of horizontal integration.

- Level of advertising expense.

“The biggest risk is not taking any risk… In a world that changing really quickly, the only strategy that is guaranteed to fail is not taking risks.”

Mark Zuckerberg

Five Forces Use

The Five Forces is a useful brainstorming tool for conducting an in-depth analysis of the competitive structure of an industry within a holistic strategic planning exercise. Furthermore, the Five Forces Tool can be used successfully to complement SWOT and PEST analyses.

0 Comments