Introduction

A startup business is an entrepreneurial venture that endeavors to validate a marketplace need by developing a viable value proposition around a founder’s innovative product, service, or processor platform. Creating a successful new business depends mainly on the chemistry and strategic alignment amongst the product concept, market approach, people, and capital.

The parallels between chess and business are unmistakable. Startups put chess principles into play regularly by positioning their pieces in a forward series of moves with a specific strategic pattern. There are differing strategic moves for offensive and defensive play, with the experienced chess player blending both sets tactically throughout the game. Business is similar to chess with continual analysis and decision-making on strategic component alignment, prioritization, and business use while they battle competitors for wins.

The parallels between chess and business are unmistakable. Startups put chess principles into play regularly by positioning their pieces in a forward series of moves with a specific strategic pattern. There are differing strategic moves for offensive and defensive play, with the experienced chess player blending both sets tactically throughout the game. Business is similar to chess with continual analysis and decision-making on strategic component alignment, prioritization, and business use while they battle competitors for wins.

Entrepreneurs are an uncommon species as less than 1% of workers start a business in any given year. Yet these individuals are essential to driving innovation and value creation. The economy and the business community realize significant benefits from the efforts of startups if the marketplace is amenable to their product’s disruption technologies and origination.

Entrepreneurs possess a rare blend of traits, behaviors, and skills that enable them to beat the odds and go after their aspirations with powerful passion and resolve. There is no recognizable human dimension blueprint to guarantee startup success. However, there are specific behaviors seen as drivers of successful entrepreneurial ventures. Capable founders tend to exhibit interactions and relations that reveal tenacity, full of positivity, need for achievement, goal orientation, need for autonomy, passion for work, creativity, and thrive on responsibility and uncertainty in abundance.

There are many difficulties and impediments associated with starting a new business and others that come with maturing it to profitability. Recent market intelligence on startup failure reports that many startups begin with boundless energy and potential. Still, about 50% do not make it past the five-year mark because the founders lack the tenacity or knowledge of how to overcome startup problems, they find themselves continuously faced with on a day-to-day basis.

Small Business Administration (SBA) research highlights:

“About twenty percent of business startups fail in the first year. About half succumb to business failure within five years. By year 10, only about 33% survive.”

With the likelihood of success, a high-risk proposition at best, it is easy to realize why founders face the first few years of their existence with much trepidation. One of their foremost challenges is the capability to quickly discover, understand, and resolve business-killing problems and risk conditions before they contaminate the business and result in real damage. Most early-stage business challenges are resolvable with a deep-dive analysis of the underlining root causes of identified pain points along with the potential risks and rewards associated with practical and straightforward fixes.

The founders who succeed have done so by becoming painstakingly aware of the likely challenges they might face and taking preemptive steps to avoid difficulties with known detrimental effects on the development and growth of a startup business.

Business survival and sustainability depend on many associated strategic elements working together in harmony that require continuous observation and adjustment. Formulating practical and useful answers and employing the right resources to execute improvement plans is paramount and a vital startup objective. A valuable best practice to support this requirement is the use of the Critical Success Factors (CSFs) technique. This approach includes the formulation of personalized corporate CSFs, supported with the construction of strategies and plans to avoid and mitigate problems and risks, leverage and/or exploit company resources, and build a structure to track performance status and highlight change opportunities painlessly.

The below graphic presents the strategic business elements recognized as critical success factors (CSFs) for business startups.

Critical Success factor (CSF) is a management science term for a strategic business element that is necessary for an organization to achieve its mission and goals.

“What do you need to start a business? Three simple things: know your product better than anyone, know your customer, and have a burning desire to succeed.”

Dave Thomas, founder of Wendy’s

The Window of Success

It’s almost impossible to believe that anyone, with any degree of accuracy, can predict whether or not a startup will succeed! Nevertheless, the creation of personalized CSFs with both defensive and offensive elements to avoid and mitigate future internal and external hazards is vital to profitable and productive business maturation. In summary, CSFs collectively form a unique strategic mechanism to identify business-threatening problems and risks and quickly initiate appropriate decisions, measures, and changes.

The table below highlights the most common issues recognized as direct catalysts for effective CSF formulation.

“Twenty years from now you will be more disappointed by the things that you didn’t do than by the ones you did do. So throw off the bowlines. Sail away from the safe harbor. Catch the trade winds in your sails. Explore. Dream. Discover.”

Mark Twain

Presented below are the vital building blocks of the most prominent discrete CSFs recognized to inspire and enable business startup success.

Planning CSF Building Blocks

The Planning CSF building blocks outlined below focus on an amateurish business plan, incoherent market research, and faulty revenue /profit forecasts.

Business Plan

A business plan has two primary objectives: a roadmap to support the company’s business activities more cohesively and; a reference point of the goals, strategies, policies, and financial projections approved for the venture. Well-crafted and realistic business plans help attract new investors and business partners by increasing confidence in the company making smart decisions.

Planning isn’t just about creating a formal business strategy; it’s about thinking and planning how to achieve the new business’s mission and formally tracking progress. There’s no right or wrong approach to creating a business plan. The bottom line is that the plan meets the needs of the founders.

An effective business planning process is typically the result of SWOT and PEST analyses that set the stage to correctly choose the appropriate corporate goals and objectives, formulate strategies, prioritize initiatives and programs, allocate resources, and establish milestones for the short and long term plans.

Benjamin Franklin’s quote:

“If you fail to plan, you are planning to fail,” applies today to the startup of a new business. No entrepreneur, establishing a company, does so planning to fail. Still, the lack of appropriate planning is a pivotal contributor to a lack of success and eventual failure.”

Most business plans are either Traditional or Lean Startup. Traditional Business Plans are more common, use a standard structure, and provide specific content.

Traditional Business Plans are more common, use a standard structure, and provide detailed content.

Lean Start-up Business Plans are less common but still use a standard structure. They focus on summarizing the essential points of the critical elements of the plan.

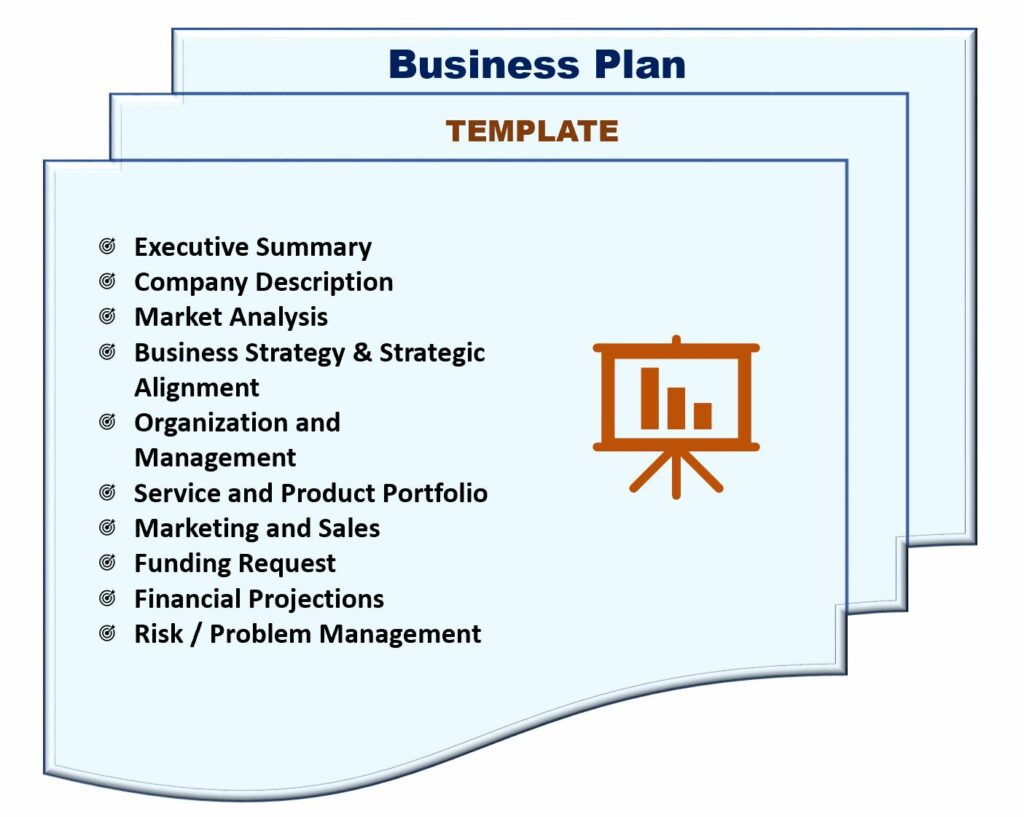

Traditional Business Plans use some combination of the below sections.

Does a business plan ensure startup success? Certainly not, however, capable and skillful planning is recognized as a critical difference between success and failure!

Sadly, entrepreneurs hurry business planning to finalize business plan completion in sacrifice to product development and funding priorities. This situation predictably results in avoidable content and format mistakes that place the startup at a high-risk condition pre-funding. Interestingly, many errors are preventable with more skilled business professionals involved with the authoring and QA process. Their experience, from previous engagements, provides a valuable context and expertise in crafting explicit and inspiring content to represent the founder’s unique product concept and business goals effectively.

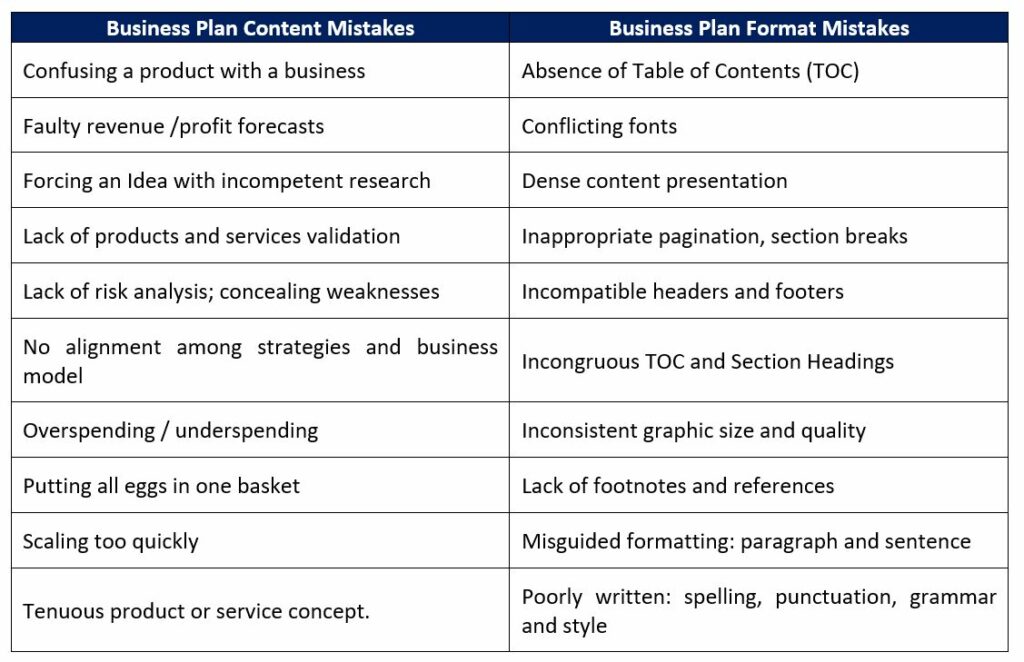

Shown below are typical business plan missteps recognized as potential obstacles singularly or in tandem with others, which may result in investors’ rejection and extensive plan changes and updates.

Market Research

For startups, market research is a critical element of the entrepreneur’s business plan. Market research recognized as a helpful planning tool provides completeness and clarity to the business plan and financial projections. Newly established companies need reliable research to validate the acceptability of the product concept and accurately assess the targeted markets for success. The research deliverable can identify potential customers’ pain points’ and their preferences for product solution processing and servicing capabilities.

It is a priority for startups to create a formal market research plan with unambiguous goals by defining the business plan data needs, craft a practical research approach, and select the most useful data collection and analysis techniques for use. The research plan includes all the information needed to make essential product and market decisions for the set-up and launch of a thriving ‘Go-to-Market’ strategic environment.

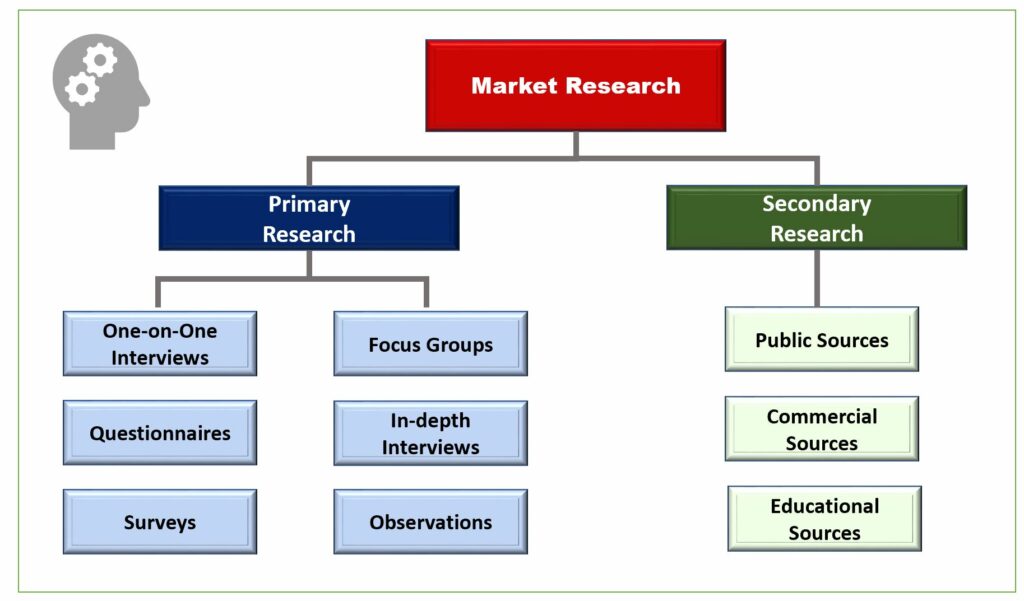

It is crucial to get answers from an unprejudiced market source via dedicated market research projects. There are two types of research projects, Primary and Secondary as defined below.

Primary

Primary research is a technique to collect data directly, rather than depending on data collected from previously conducted research and other sources. This technique addresses a particular problem, which requires data and in-depth analysis.

Primary research includes two approaches: quantitative and qualitative, with each using a different process and data discovery method.

Secondary

Secondary research is a technique to gather and synthesis of existing research information. This technique uses previously completed primary research as suppliers of the required data.

While secondary research is less focused than primary research, it can provide valuable material and answer questions not practical to obtain through primary research or issues that may make customers uncomfortable if asked directly.

Market research provides focused and valuable data to help startups substantiate and support decision-making for:

- Products and services design.

- Targeted markets.

- Prospective customer ‘pain points’, needs and purchases criteria.

- Pricing.

- Go-to-market programs components.

- Market competition.

- Opportunities for cross-selling and upselling.

- Governmental regulations and rules compliance.

Startup founders need to be open-minded and adaptable when conducting market research as some data discovery may not validate their hypothesis and conflicts with the business planning criteria. This condition is, however, beneficial as it allows the company to reconsider their earlier positions and make changes to accommodate customer and market preferences and perceived problems and risks.

In this spirit, the output of research projects needs to align with the startup business plan to ensure that an adequately documented and validated product concept is supportable by the company’s strategies, goals, and business model.

Revenue and Profit Forecasts

Investors may find it challenging to evaluate a new business startup. Still, they can usually assess the reasoning behind startup forecasts and supporting figures and compare them with previous similar experiences and rational business norms. Most investors, over the years, developed personalized commercial “rules of thumb” that help them determine if a startup is fundable, with their assessments of the founders and team and the primary business concept.

One of the most significant contributors to startup success is a credible business plan that includes consequential financial projections. Incidentally, startups must understand that this truism requires laser-focused attention to quality forecast production. This proactive action will surely help the investors quickly complete their due diligence of the new product or service opportunity and make their funding decision.

Investor-acceptable forecasts typically are prepared within the guidelines below.

- Financial projections supported by a rational business strategy, as described in the business plan.

- Revenue projections show the penetration of the target market opportunity.

- Revenue increasing overtime at an attractive yet realistic rate.

- Profitability forecasts indicate conformity with acceptable industry norms.

- Growth projections provide an aggressive versus conservative approach.

- Financial ratios included as soundness checks.

- Produce different scenarios: most likely case, best case, and worst case.

Experienced startup financial consultants have the skills to help startup management build logical and believable business assumptions to increase the probability of plan realization. Continual refining the projections with the use of actual company results can help new businesses develop and mature a successful growth strategy.

The late Peter Drucker, one of the leading management thinkers of the 20th century, said it best:

“The entrepreneurial mystique? It’s not magic, it’s not mysterious, and it has nothing to do with the genes. It’s a discipline. And, like any discipline, it can be learned.”

Governance CSF Building Blocks

The Governance CSF building blocks outlined below focus on ineffective leadership, protracted decision-making, and inferior communications.

Leadership

Startup founders appear to be visionary leaders, continually coming up with innovative concepts and products, supervising and motivating the team, and taking responsibility for business success or failure. However, the cadre of founders who successfully evolve from the run of the mill managers, with raw leadership skills, into successful long-term leaders is limited. The main reason is that founders typically don’t take the time to recognize and adequately appreciate the universe of innate personality traits and learned behaviors that form the foundation of a capable and well-respected leader.

It is highly critical that founders identify their traits and behaviors and calculate the weight and value for all characteristics that impact their leadership role. It would also be helpful to formulate initial and follow-up actions to leverage positive traits and behaviors and reinforce or create workarounds for negative characteristics and behaviors.

Leadership is the most powerful and critical element of a successful startup. Talented and respected leaders with the necessary tools and skills inspire and impact their followers, empower new businesses to operate successfully in positive and negative economies, and market disruptions.

The benefits of superior leaders provide a wide array of values and interests that drive improved:

- Ability to succeed under pressure.

- Change enabler

- Conflict resolution.

- Cultivate future leaders.

- Decision-making.

- Dependable and competent workforce.

- Emotional intelligence.

- Employee motivation and engagement.

- Employee retention.

- Financial results.

- Innovation and creativeness.

- Communication and listening skills.

- Productivity

“Do not go where the path may lead, go instead where there is no path and leave a trail.”

Ralph Waldo Emerson

Decision-Making

Successful startups require skilled and experienced people who continually and dynamically make smart and appropriate decisions and drive positive and value-add outcomes. Capable managers plan, organize, staff, lead, and control, their areas of responsibility, by executing workable and pragmatic decisions.

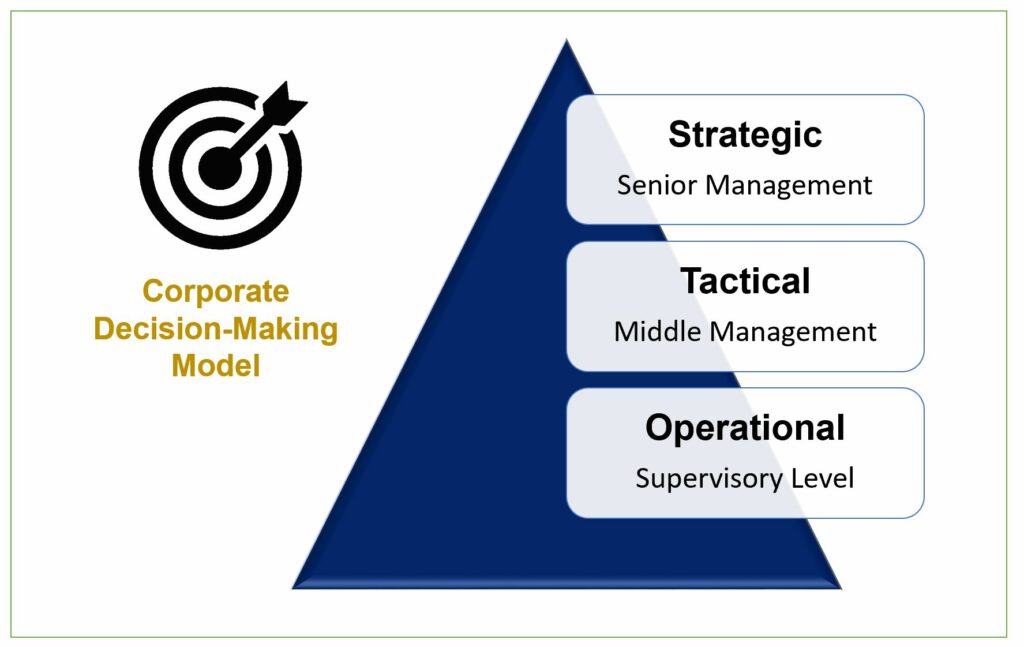

Corporate decision-making is a critical responsibility at the strategic as well as the tactical and operational levels. Effective decision-making occurs primarily within a waterfall framework where strategic initiatives influence and drive the successful enactment of tactical and operational actions throughout the business activities. Lesson-learned from collective market research is a testimony of the difficulty for startups to reach their full potential absent founders, executives, and managers without the necessary skills and experience to make correct and timely decisions.

Managerial individuals predisposed with personal biases tend to lose sight of the bigger picture and backstory, leading to the absence of objectivity in decision-making.

They usually make poor decisions on complex and challenging issues intending to advance their agenda and career ambitions over their company. Managers that are not ready for prime-time leadership roles are prone to fall into the trap of making bad decisions with a lack of understanding of the decisions’ strategic value, everyday practicalities, and outcomes.

Startups founders must craft policies and procedures to avoid or eliminate instances of the below decision-influencing behavioral patterns among their management team.

- Addict to corporate politics.

- Too much or not enough information.

- Problem misidentification.

- Can’t see the forest for the trees.

- Don’t trust themselves to lead.

- Fail to communicate the what, where, when, and how associated with their decisions.

- Absence of strategic alignment.

- Lack of clarity of purpose.

- Mismanage resources (human and financial).

- Lack of risk mitigation planning.

- Place too much emphasis on past experiences.

Communications

The wide assortment of the problems that influence startup success, resulting in missteps and even collapse, are related and defined in a broad category described as “communication.” Think of communication as the adhesive that binds and synchronizes a company’s loosely-coupled business activities in harmony.

Without effective communications, the many different progressive business actions and events may be interrupted, and the realization of projected financials definitely at risk. Also, with the lack of formality in internal communications, employees may operate under wrong or misleading guidelines and assumptions, given the lack of timely and appropriate directions and supporting information.

In years past, there were generally three communication vehicles, including face-to-face, telephone, and snail-mail. Today, for better or for worse, there are many ways to propagate company internal information. In addition to the traditional methods, the workplace communicates with the use of email, mobile apps, video, and video platforms such as GoToMeeting or Skype.

The disadvantage of the use of many high-tech communication approaches is that most employees experience communication fatigue that may lead to burnout and potentially turnover. Many workers devote significant segments of their productive day responding to emails, instant messages, and other platform messages. This condition can be extremely problematic to startup employees with the completion of assigned deliverables within a highly time-sensitive schedule.

With the current array of technologically-advanced communications approaches available, the startup must agree early in the planning stage on a plan including policy, procedures, and methods to formally communicate regularly with all employees, stakeholders, and investors.

Financial CSF Building Blocks

The Financial CSF building blocks outlined below focus on unsuccessful capital acquisition, runaway burn rate, and unsuitable product pricing.

Capital

Raising funds is a formidable task for unproven founders as the practice involves the adoption of various resourceful and time-consuming approaches to engage and beguile potential investors to believe in the value of the venture’s financial opportunity.

The period between the decision to set-up a new business and generation of revenue is the vortex where there is a real need for funding to offset the financial outlay on required immediate and periodic expenses. During this time, cash flow is diligently monitored as a daily occurrence to ensure that necessary funds are on hand to cover business expenses as they become payable. It can be enticing for founders to continue the use of individual credit cards and personal loans. Still, eventually, those debts must become payable, and the interest becomes a significant drag on the new business.

There is no specific period after which a business needs to raise funds. Startups need to commence their capital funding research and search activities well before the company reaches a critical adverse cashflow condition. The industry segments that provide the bulk of startup funding are recognized to be slow-moving in their processing, so founders must move their applications with a sense of purpose and urgency in dealing with financial providers.

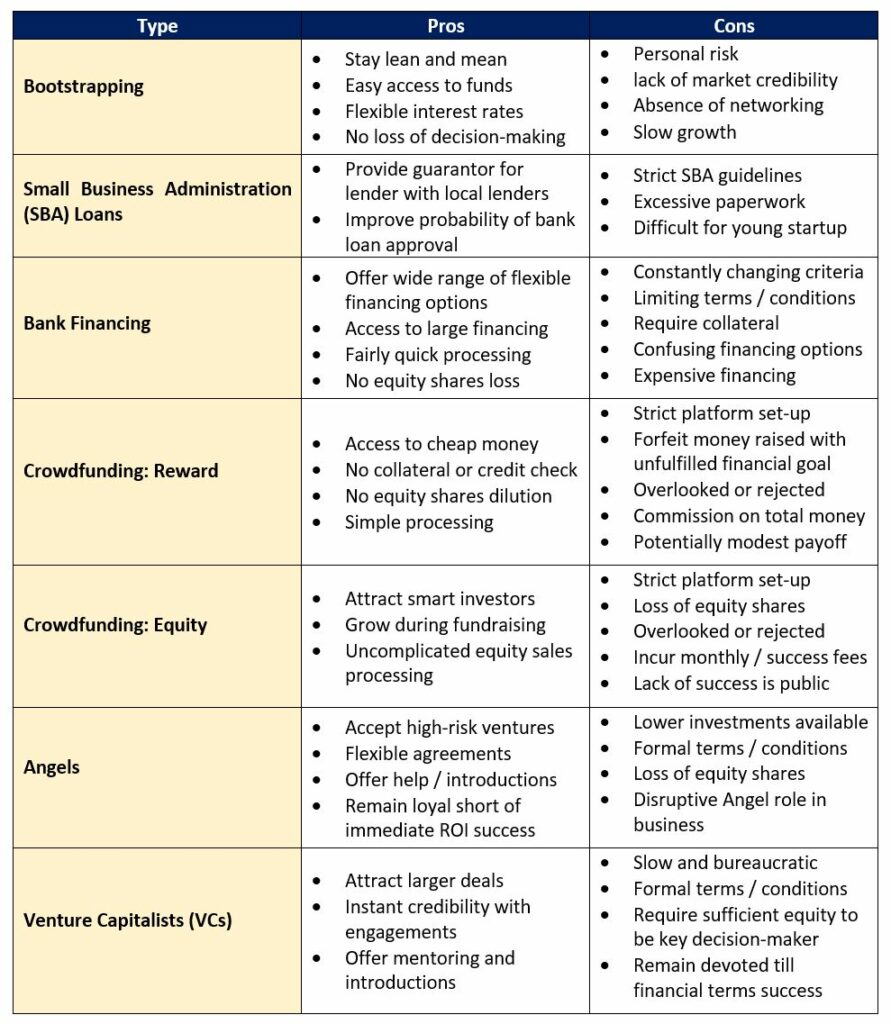

Depending on the company’s life cycle stage, business model characteristics, and resource use, founders have access to a wide array of financing, as shown in the below graphic.

Bootstrapping, among other funding sources, is the best way to kick off a startup business. Though, to remain viable, founders should continually interchange their funding sources. This approach provides a level of flexibility and over-dependence on one source of funding.

Founders, embarking upon the financing route, need to have a clear picture of the position of their product and identified their set of targeted customers and markets. The key driver to raise funds is the ability to convince investors about the potential customers’ needs and their product fit. Investors also favor funding startups built within a scalable framework with the capacity to successfully increase revenue with an acceptable level of supporting expenditures in both short and long-term projections. This information is essentially the heart of the new company’s business plan and financial projections.

The barriers typically encountered in securing startup funds include those associated with the founder (or founders) background and the startup business environment.

Founders Background

The warning signs uncovered from the founders’ background include:

- Uncomplimentary reputation and references.

- Low personal credit score.

- Past bankruptcy filing.

- Record of business failings.

- History of litigation.

Startup Business Environment

The startup business may complicate raising the required investments with problems that include:

- Weak founder and management team.

- Unfilled critical roles for employees with needed behaviors, skills, competencies, and experiences.

- Incomplete or weak business plan.

- Absence of product concept ‘pain points’ identification and quantification of product potential.

- Lack of professional Go-to-Market Model.

- Workable prototype with potential customer feedback

- No discovery and validation of unique competitive advantage.

- Unrealistic revenue and profit projections.

- Lack of assessment of potential risks and mitigation plan.

The extensive list of barriers confirms that startups have many challenges to overcome on the road to a successful venture. For this reason, the founders must address each individually and create ways to eliminate the barriers before embarking on a search for financing. Lack of access to capital can present many obstacles and have significant consequences for business growth, business performance, and business growth.

Expenses / Burn Rate

Market research supports that about 80% of startups fail because of illiquidity cash flow problems attributed to their cash burn rate. A business can survive without profit for a while, but not without cash!

But what exactly is a cash burn rate, and how do you compute this necessary calculation?

The burn rate is the rate at which the business uses or ‘burns’ its liquid cash. Burn rate is effectively the negative cash flow and a critical metric for recognizing the new company’s overall financial health. Startups sensibly compute burn rates for the period during which early-stage financing, loans, private equity investing forms the company’s operating capital.

There is no appropriate burn rate or way to calculate a startup’s funding requirements. Startup founders establish their new ventures based on unique and competitive business models, with varying revenue and development and operational expenses.

Calculation of the burn rate enables continual tracking of the cash used monthly to fund the startup’s operations. This activity, in turn, allows the management team to readily understand the time left before the business becomes illiquid and triggers the enactment of a contingency plan. Once a startup begins generating positive cash flow, the burn rate is usually not viewed as a critical metric.

Successful startups focus their energies in the early stages of expense management with an approach that encompasses:

Expense Management Policy

When it comes to an understanding of all conditions of a business expense policy, it can become something of a nightmare for effective employee compliance. Many startup purchasing policies are vague as to what can and cannot be bought and claimed as business expenses. Startups classically make the situation worse by not providing detailed clarification and guidelines for their employees. This condition may lead to much uncertainty and inconvenience for employees and potential financial exposure for the business.

No matter how well-prepared an expense policy, some transactions require a judgment call to finalize the processing. By addressing situations in the policy with potential for confusion, delays in reimbursements and mistakes are avoidable.

It is essential to prepare an expense management policy to prevent the misuse of company funds.

The ‘rule of thumb’ goals for a best practice expense management policy include:

- All company expenses linked with approved business strategies and plans.

- All company expenses identified in approved financial budget categories.

- Employees require authorized manager review and approval of receipt-supporting expenses.

- Employees are never ‘out-of-pocket’ for approved purchases resulting from their assigned roles and responsibilities.

Government Tax Regulations and Rules

It is essential to understand all federal and local government tax laws and compliance requirements for business expenses. The IRS and states have a broad array of laws that may impact business expense policy, including types of eligible expenses, limits and other conditions, and records management requirements.

Expense Management: Technology Support

Work expenses usually do not occur in the office. Often, business purchases take place outside the office and online. Using an expense management solution that has a mobile app that encourage employees to submit expenses reports quicker and more accurately. These types of solutions support automation of the expense processing workflow customized to the company expense policy and integrated with the business accounting system.

The use of a capable expense solution provides a startup with an improved awareness of projected and planned expenses and allows time for assessment and adjustment as required. An integrated and comprehensive expense management platform offers intuitive expense oversight, convenient and straightforward validation processes, and flexible modes of payment, all without sacrificing security. Having more precise insights and a formalized control over company expenses reduces employee time and effort with a redirect to other priority activities.

Pricing

A pricing strategy is a decision process to determine the prices a company must sell its products and services to realize a profit. It’s one of the most commonly neglected and undervalued revenue levers in business. The essential characteristic of a winning pricing strategy is the alignment of the product’s value and the customer’s willingness to pay. Startups have a tendency of setting their price low to appeal to customers and never raising it or keeping a feature free long after it’s recognized people will pay.

Getting pricing right requires an experimental approach and commitment to conduct direct and frank conversations with potential customers. Value in a pricing context is the value customers receive from the use of a product or service. This element is not a feature or a price point, but the customer’s motivation to buy and use a particular product. Startups habitually fixate on the gap between how much the product cost to produce and the offering price. It is equally important to focus on the difference between the price and the value customers believe it realizes, a concept characterized as perceived value.

In crafting a successful pricing strategy, it is critical to identify what attracts likely consumers and what they are willing to pay for the product’s recognized value. While subtle, the distinction is relevant; just because someone is interested in a product doesn’t mean they’re prepared to buy at any price.

The product price set also influences its perceived value among buyers. That’s why many people believe that a $100 bottle of champagne is significantly better than a far less expensive bottle. In that sense, price is essentially a proxy for product quality!

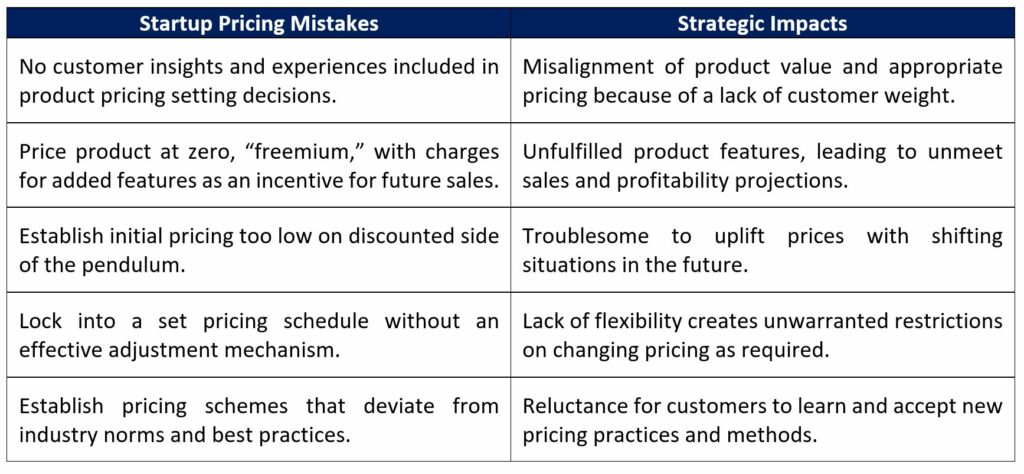

The mistakes that startups often make in product pricing activities include:

Building an appropriate pricing strategy means identifying financial tradeoffs. For startups, this consists of a focus on the growth rate, market penetration, and profitability. The management team should evaluate the planned short-term gains and the consequences those choices potentially have for sustainability beyond.

When startups fail to optimize pricing, they are throwing off the math that powers the primary finances of the business model. Then again, pricing is such a significant growth opportunity because optimizing pricing enables a company to be exceedingly more productive.

The creation of a pricing hypothesis is critical to the ultimate goal of setting product prices that will be a crucial driver for market success. The theory helps assess a product’s perceived value and the accuracy of its price and consists of the following analysis elements:

- Opinions that customers will likely express upon first encountering the product.

- Products that users could easily use in place of the product.

- Additional associated products customers would likely use along with the product.

- Potential customers value assessment of the product with an intuitive snap judgment.

- Potential customers’ value opinion after a thorough product analysis.

- Potential customers’ perceived value influenced by competitive products and possible substitutes.

There is no standard pricing strategy commonly used and accepted for startups. The pricing approaches highlighted in the accompanying graphic are customizable based on the company’s business model and current SWOT (Strengths, Weaknesses, Opportunities, Threats) analysis circumstances.

There is no standard pricing strategy commonly used and accepted for startups. The pricing approaches highlighted in the accompanying graphic are customizable based on the company’s business model and current SWOT (Strengths, Weaknesses, Opportunities, Threats) analysis circumstances.

Technological CSF Building Blocks

The Technological CSF building blocks outlined below focus on undeveloped infrastructure, disjointed prototype and feedback and, obsolete value chain.

Infrastructure

There is a recognized association between startup failure and the lack of an adequate and quality-focused technical infrastructure. However, with uncomplicated and cost-effective access to advanced technologies and premium solution providers and outsourcers services, startups can now painlessly set up a technology architecture that supports their unique business model and strategies. As a result, startups can today mature their business more quickly with more the addition of advanced product production and customer service capabilities than ever before.

Startup management must stay up to date with the ever-increasing velocity of innovation and change occurring with business technology and innovative application with their targeted products and processing requirements. They must ensure immediate review and interpretation of the newly introduced technologies with their current (and planned) infrastructure and be in a position to make smart technology selection and adoption decisions as required.

Making the correct decision to fund new or upgraded business technology is critical for the continuance of the startup’s high productivity level goal, maintaining or improving market competitiveness, and as a future market sustainability driver.

Many founders, unfortunately, focus their attention only on the immediate short-term benefits the new technology will offer the business. In this regard, they often fail to assess the potential value for future production and customer service needs. For example, migration, integration, and scalability are essential areas of consideration when viewing the business plan and financial projections with a long-term view.

If a company isn’t sufficiently nimble or unable to decide on technology use on a timely basis, the window of opportunity may very well close before their product is ready for launch. It is evident in the current technology-fueled market that high-value solutions will catch the eye of other manufacturers and replicated with similar or additional functionality to fill the market gap of user needs quickly.

“People who succeed have momentum. The more they succeed, the more they want to succeed, and the more they find a way to succeed. Similarly, when someone is failing, the tendency is to get on a downward spiral that can even become a self-fulfilling prophecy.”

Tony Robbins

Prototype

In the early stages of a startup, it is essential to develop a prototype of the product to justify the founder’s original idea and design. The prototype, an early sample of the product, generally used to evaluate a new model to enhance precision by engineers, marketing professionals, and potential users. Prototyping serves to provide detailed specifications for a real, working system rather than a theoretical one.

A challenge for founders is convincing venture capitalists, angel investors, and crowdfunding audiences, to invest in a startup product. It isn’t easy to sell a concept without the availability of a working prototype that demonstrates the value-add user functionality.

Startup companies can reduce market risks and initial project funding and avoid premature product launch disasters with iteratively development efforts to meet customer needs. This approach decreases inefficient and wasteful practices and strengthens product value in the early product development stages. The successful use of the lean startup approach can improve the potential for new business success without developing a picture-perfect product on the initial launch.

Customer feedback during product development and launch is precious and integral to the lean startup process. It ensures that the company does not invest unnecessary time, money, and resources designing features that consumers do not want or value.

When a business startup is unable to support the development of a perfect product for lack of financial or skilled resources, the lean startup advocates use of a Minimum Viable Product (MVP) product launch of a less than complete feature set.

A MVP product consists of sufficient features to satisfy early adopter customers and enable useful feedback for current product enhancement and future development activities.

MVP differs from the conventional market testing strategy of investing time and money early to implement a product before market testing.

Value Chain

Traditional value chain models are being transformed by tech-savvy founders who creatively restructure the value chain and redefine value to the end customer. Digital and other technological innovations and emerging technology are the critical drivers for the shift of the design, manufacturing, commercialization, distribution, and support efforts to more cost-effective and quality-focused partners.

Enabling technologies and shifting customer buying behaviors allow startups to remove low-value stages or move stages to different types of participants and obtain financial benefits for themselves and customers. The capability to quickly recognize, understand, and promptly respond to fluctuating customer needs in complicated value chains is challenging.

In this regard, startups can painlessly construct complex value chains with ‘start-of-the-art’ digital capabilities and process and decision productivity-focused streamlining techniques quickly. The outcomes can be dramatic, with reduced capital requirements, manageable infrastructure costs, and increased customer loyalty.

Most founders and teams are seemingly capable of creating the components that comprise the ‘secret sauce’ that underwrites their product’s exclusive business and technical appeal. Though, they may be deficient in the competencies to fabricate particular complex parts. For this reason, startups, as a ‘best practice,’ need to engage strategic partners, as active value chain participants, to build specialty components as required.

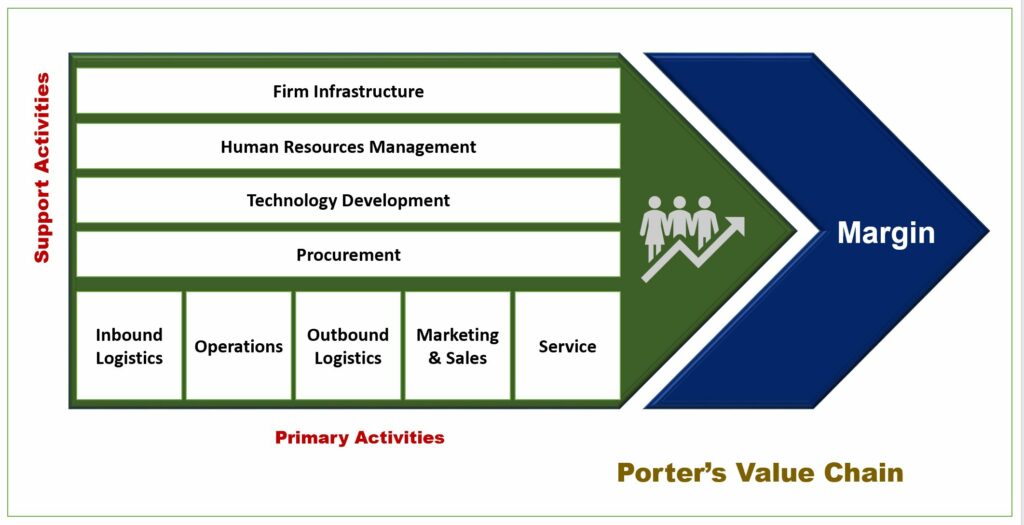

Michael Porter, in his 1985 book “Competitive Advantage,” introduced the concept of the Value Chain.

Porter defined the ‘Value Chain’ (VC) as representing all the internal activities a firm engages in to produce goods and services. The VC consists of primary activities that add value to the final product directly and support activities that add value indirectly. This approach links operations and activities to each other and establishes what effect this has on costs and profit.

Presented below is a graphic of Porter’s original Value Chain.

It is critical, within the startup’s business planning activities, to include the design and construction of a customized value chain that supports the company’s products and delivery to target customers. The use of the Value Chain Analysis (VCA) technique can facilitate the recognition and quantification of an organization’s most valuable activities, representing the root source of cost or differentiation advantage, and those activities that could be leveraged or exploited to improve competitive advantage. Mapping a value chain can be an excellent practice to envisage and analyze a company’s processes and understand their current and future impact internally and directly with customers. The VCA deliverable is commonly a key driver of corporate value proposition improvements that result in positive effects on revenue, profit, and productivity.

“Competitive advantage cannot be understood by looking at a firm as a whole,” Michael Porter wrote. “It stems from the many discrete activities a firm performs in designing, producing, marketing, delivering and supporting its product. Each of these activities can contribute to a firm’s relative cost position and create a basis for differentiation.”

Product / Market CSF Building Blocks

The Product / Market CSF building blocks outlined below focus on substandard idea validation, undeveloped sales channels, and unproven customer services.

Idea Validation

Most founders believe their innovative idea is one of a kind and will quickly generate market appeal as a value-added commercial product or service. These individuals, referred to as ‘First Movers’ with goals, to achieve an insurmountable market position swiftly with a highly competitive offering and to be the first to establish itself, as the vendor of choice, in a given market.

Experience shows that entrepreneurs are subjective in their assessment and judgment of their discoveries. For this reason, most startup forecasts are highly optimistic and lack a realist validation of the potential for a successful business with a particular product or service. The objective of idea validation is to ensure that a specific idea has true market potential and can solve a real problem with a set of targeted users.

Idea validation is a method for the gathering of supportive material and learnings around a hypothesis through interviewing, brainstorming, experimentation, and user testing, to enable fast, informed, and risk-managed decisions. New ideas commonly have capricious aspects, and any individual element can influence the failure of the total opportunity. Validation benefits cover risk reduction, improve timing, and minimizes the costs.

The startup management team must conduct an idea validation event to improve financial projections and confidence of potential investors in the business model and approach. The scope of a typical idea validation event consists of the below activities.

- Define the scope of Ideas/theory for validation.

- Identify idea/theory elements and priority.

- Characterize associated assumptions. (Desirability – customer focus, Viability – business model, Feasibility – tech possibilities, and Corporate Fit – strategic alignment)

- Design Idea/theory hypotheses.

- Develop an approach and select tools and techniques.

- Create relevant experiments to test hypotheses. (brainstorming, interviewing, focus groups, benchmarking, and user testing)

- Evaluate findings, formulate conclusions, and create recommendations on idea improvement.

Successful validation events typically use the ‘Picnic in the Graveyard‘ technique that involves learning about similar products that failed in the past and interviewing users and founders to identify what did and didn’t work and get the real story and learnings from them.

Secondary research comprises of current data such as the company documents, texts, articles, and previous studies and the universe of information available via Internet discovery. This material is useful to reinforce insights from primary research. It can also be a starting point of a design challenge to help uncover the problems or basic needs of a large, unfamiliar market.

“You can’t connect the dots looking forward; you can only connect them looking backwards. So you have to trust that the dots will somehow connect in your future. You have to trust in something—your gut, destiny, life, karma, whatever. This approach has never let me down, and it has made all the difference in my life.”

Steve Jobs

Sales Channels

A key decision point for startups is determining whether to embrace direct, indirect, or a mixture of sales channel strategies. Within these channels, there is an array of revenue streams, including new sales, up-sell, and cross-sell, that require different approaches and supporting resources. There’s no right or wrong approach that is best for successful business development. The answer classically depends on the founder’s (and management team) business philosophy, financial situation, employee competencies and experiences, types of products and services, and target market.

Today, powerful digital platforms and tools are enabling startups to open new channels and broaden their customer reach, driving increased revenue streams, profits, and financial performance. In practice, most startups rely on a combination of direct and indirect sales strategies and thereby take advantage of the benefits afforded by both categories in the digital age.

Descriptions of the direct and indirect approach follow with pros and cons, and critical negotiating points for channel partner selection.

Direct Sales (Corporate Team)

Direct sales activities support companies selling their products and services directly to consumers without the use of an intermediary (resellers).

With a direct sales approach, a business is in charge of its destiny and success in the financial plan. Building a professional corporate sales team is often challenging for startups, given their limited resources and marketing budget. However, startups would rather not have anyone in between them and potential customers. The direct selling direct approach enables the company to stay close to its market and customers, to obtain valuable customer intelligence continually, and monitor the competitive developments.

With the innovative and targeted use of digital tools and platforms, businesses no longer need to rely on traditional retail and wholesale distribution and sales partner channels. Today’s business technologies enable startups to create their internal direct-to-consumer channels far more quickly and cost-effectively than in past times.

Social media tools, such as Facebook, Twitter, Instagram, and Pinterest, have transfigured the way that customers and businesses interact with one another in sales and services activities. Also, digital marketplaces, mobile apps, e-readers, and electronic kiosks now make it substantially easier to establish e-Commerce channels.

Smart startups can use the data collected from their interactions to continually enrich their products and services and better align with customers’ needs and demands. They can also expand their market reach and do it without making significant investments in infrastructure or establishing new vendor agreements with regional or local distributors.

As a consequence of the introduction of digital-based sales platforms and activities, the top industry resellers have also adopted these technologies as they have invested significant financial and human resources in developing and setting-up highly competitive digital-based services. With the reseller community strategically focused on the construction of highly effective platforms, startups will need to consider tradeoffs in the potential selection of a channel partner.

Indirect Sales (Channel Partners)

Channel partners supply the organization structure and professional resources to sell products and services on behalf of other businesses, typically by segmenting on different selling vessels. They may also offer products and services produced by other companies as well as items they create themselves.

The indirect sales strategy supplies formidable leverage to a company’s business model by adding top-up professional sales resources and potential sales to the existing channel partner customer relationships.

It is not unexpected that startups make the common misstep of concentrating their energies and resources mainly on product development while engaging channel partners to be responsible for their sales activities. It can be very attractive for startups to ‘go to market’ with an indirect strategy since recognized resellers can instantly lend credibility to their brand and offerings, increase revenue potential with extra prospect exposure, and serve as a multiplier for further brand expansion.

In negotiating channel partner agreements, the below questions need to be mutually understood and agreed upon by both parties.

- Does the channel partner have a loyal and profitable customer base, and are they recognized as a premium reseller in the target market?

- Is this a financially win-win agreement for both parties?

- What are the specific role and responsibilities of all stakeholders?

- What is the cost of setting up the agreement? (in financial terms)

- Are the economic conditions in any way restrictive to current and future sales and revenue generation?

- What are the fundamental pre-sales process interactions and decision points?

- How will both parties handle prospective leads and the pipeline?

- What are the prescribed causes of contract termination?

Experience identifies the below as positive reasons for consideration and response when considering the use of an indirect sales strategy.

- Setup and use of an existing marketing and sales infrastructure and resources quickly and cost-effectively.

- Rapid and effective scaling.

- Less expensive for expanding into new markets.

The potential problems encountered with channel partner engagement cover:

- Less control over the sales process.

- Restrictive access to customers.

- Loss of pricing flexibility.

- Less predictable revenues.

- Partner discounts.

- Reseller exclusivity.

- Liquidity terms.

A startup is usually negotiating from a weaker position then a highly recognized and successful reseller. The startup that confers exclusivity to a reseller on their primary (and only) target market, should understand that condition is indistinguishable to an acquisition, and be priced accordingly. Also, startups should make sure that exclusivity is not a way to exclude them from the market. In mitigate this type of situation, there should be a minimum monthly or yearly purchases clause in the agreement, or the exclusivity is forfeited.

According to CB Insights:

“42 percent of startups failed because there was no market need for that product or service. They either didn’t create something that people wanted, or they were targeting the wrong users.”

Customer Services

Rule one for successful businesses is that the customer is always king, and there are no other rules! Winning a customer’s trust and loyalty is one of the most important goals that new ventures face continuously. With a highly satisfied and loyal customer base, startups can scale the business and realize their financial projections.

Naturally, startup founders have a dedication and a passion for building and selling the ultimate product. On the other hand, there usually is a lack of urgency in ensuring the effectiveness and quality of their customer-facing activities. Customer delight is the key to business success, especially startup companies! This notion isn’t anything new or novel; in fact, customer service is consistently rated by business leaders as the most significant success contributor.

The most highly recognized business proceedings and events identified as catalysts of customer concerns that trigger customer problems encompass:

- Too many process steps and rules that incorporate unnecessary delays and obstacles in resolving customer questions and issues.

- Customer service activity is a subtle name for customer complaints. The unnecessary effort and cost expended in resolving customer problems rather than avoiding their occurrence is the expensive outcome of this situation.

- Employees are not empowered to make ”on the spot’ decisions during customer ‘moment of truth’ interactions.

- Employees must seek approval for less critical customer problems, from a more senior employee, thus delaying resolutions and extending interactions unnecessarily. Well-trained but less senior employees can quickly resolve this condition with appropriate tactical decision-making training and authority.

- Employees lack the motivation to please customers because there is no incentive (financial or non-financial) available for performance. The absence of a business intelligence system to measure and report on employee performance also contributes to a failing customer service environment.

- Arbitrary policies followed blindly by employees lack situational allowances exceptions that can decrease problem escalations and expenses associated with the interactions and processing.

The startup business must develop a strategy with the rule that puts the customer first by addressing specific plans to mitigate the concerns outlined above. Understandably, customers will receive the best possible service when employees are appropriately empowered.

Talent CSF Building Blocks

The Talent CSF building blocks outlined below focus on onerous recruiting / onboarding, substandard training, and reluctance to engage mentors.

Recruiting

One of the essential elements that characterize a startup’s organizational culture is the synergy of the employees. A business comprised of people with similar traits and behaviors is an asset in plan achievement. To develop a winning team culture, founders must place a priority on identifying and employing suitable candidates.

The startup recruiting process is radically different and more complicated than that of a traditional corporate entity. Established businesses have well organized and transparent infrastructure and operation with supporting ‘best practice’ hiring procedures. They also have the means necessary to research, interview, conduct due diligence professionally, and effectively onboard and introduce newly-hired employees to the company environment in a timely fashion. Startups don’t have this type of comfort resources and are at a competitive disadvantage in finding top talent!

Recruiting startup employees is usually conducted within an unfamiliar process with limited means. It is considered a nerve-wracking experience with the excessive time, effort, and expense required to identify and hire the desired candidates.

The recruiting struggles faced by startups expose a new business to the risk of being unable to meet business plan goals and financial commitments. It is a big gamble for well-established corporate employees to depart a highly-recognized, secure, and profitable brand to work in a recently established company. Why would an experienced and valuable employee leave an established company with an excellent reputation that offers a much higher salary and benefits?

Collectively, the many challenges faced by founders increase the risk to scale a new business quickly with the required competencies successfully. It is critical for startup management to create, early in the business planning cycle, specific strategies, and plans to avoid, mitigate, or provide a pragmatic workaround for the below recruitment problems.

- No dedicated human resources professional with recruiting experiences and industry contacts.

- Unknown business and not recognized as an established and trustworthy corporate brand with a formidable reputation.

- Candidates’ predisposed that startups are a high-risk proposition.

- Unable to compete with compensation packages, benefits, and workplace amenities offered of established businesses.

- Settle for hiring good employees when there is an opportunity to find great ones, even if it takes longer.

“One point here is that we regularly confuse people with roles and confuse talent with broad skill pools. In many organizations, roles today bear no resemblance to what they’d look like if you were designing them from scratch. Get clear in your head: What are the few critical roles? There are probably a couple dozen. That’s it.”

McKinsey

When it comes to startup recruiting, every action and every decision is vital. Because of the smaller business size, a newly hired employee can contribute tremendously and often quickly to the startup’s value and success. On the other hand, the cost of a failed hire is more costly in startups where individuals may unsettle a business beyond repair in both the short and long term.

“You don’t build a business, you build people, then people build the business.”

Zig Ziglar

Training

Employee training is a critical support activity that startups tend to avoid, delay, or approve with skeleton resources. For many startups, employee training is not a priority, with funds earmarked to other strategic undertakings. Founders with limited corporate-level management experience predictably place limited importance on the valuable tradeoffs associated with highly-effective training.

“Organizations with neglected learning cultures experience high talent turnover, struggle to keep customers, and ultimately fall behind competitors.”

Oracle University

Nowadays, the cost of employee training doesn’t need to be a barrier to professional development, with so many painless approaches to deliver cost-effective and invaluable online training that’s relevant to productivity and profitability improvement.

Successful startups believe in the linkage between training and productivity. For example, the National Center on the Educational Quality of the Workforce study of 3,100 U.S. workplaces found that, on average, an increase in workforce education by 10%, will lead to a productivity increase of 8.6%.

The learning characteristics of workers in a startup culture influence the type and delivery of training programs, as outlined below.

- Accept ambiguity and thrive in informal structures.

- Build community by developing strong relationships.

- Collaborate and share knowledge, and encourage others to do the same.

- Predisposition to self-learning.

- Willing to train and mentor others.

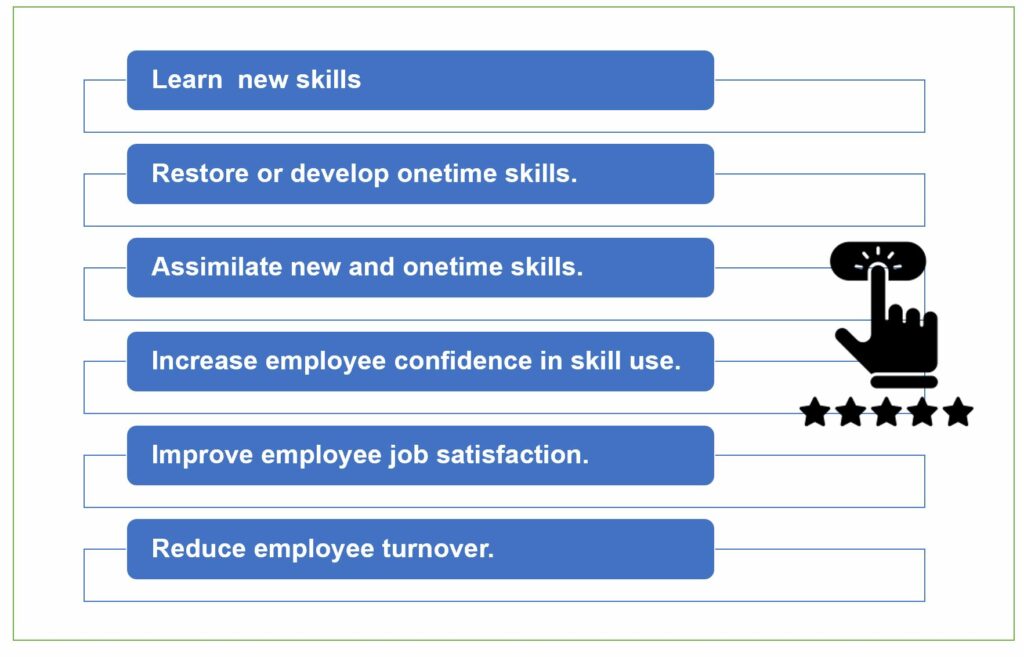

Formal corporate training typically improves employee productivity within their assigned areas of responsibility, as outlined below.

Newly established companies must promote a culture of learning and knowledge sharing by creating the motivations and incentives for both company success and employee career development.

Startups that elect to set-up a formal training program typically work with limited human resources, a restrictive budget, and constrained time in establishing the program and commencement of employee training activities. Before creating any training program, it is vital to identify what skills employees are lacking, competencies that need refreshment, and what knowledge and experience is essential for them to perform at a higher performance level. These skills are different for every industry, and role and responsibility, so ample time needs to be invested in researching and conducting an employee needs/skills analysis.

In any program establishment, consideration must be given to the below business training and learning practices.

- Create a training program plan based on company strategy and business model.

- Create hard and soft skills training experiences.

- Build, purchase, or engage services platform provider for use as e-learning training solution.

- Cater to different employee learning styles.

- Drive training through multiple channels.

- Create and embed micro-learning where appropriate.

- Gamify the technology approach.

- Incentivize employee participants.

- Assess training effectiveness with a feedback loop.

Skill-building should be a continuing pursuit, as it is revitalizing for employees to learn and attempt to master an endeavor or practice continually. Within business, professional development opportunities are highly valued by employees who view skill-building or training as a valuable stepping-stone toward career advancement.

“Train people well enough so they can leave, but treat them well enough so they don’t want to.”

Richard Branson

Mentors

One of the most illuminating ‘Moments of Truth’ for entrepreneurs is recognizing and accepting that they lack the necessary skills and knowledge for setting up, maturing, and operating a successful startup business. While going it alone can enable a great deal of personal pride, not least individuality, fulfillment, and potential profits, there are many trials and tribulations to overcome to the realization of a sustaining and profitable business.

Many people believe that they need to make their own mistakes to learn from them. However, experience supports that the best and most effective path to business success is collaborating with men and women who can recognize the characteristics of both failure and success!

Business startup mentors, such as management consultants, attorneys, and accountants, within a defined scope, can provide priceless experience and insight to help founders recognize, understand, prioritize, and handle the mandates, complexities, and difficulties of the legal, regulatory, and industry best practices requirements.

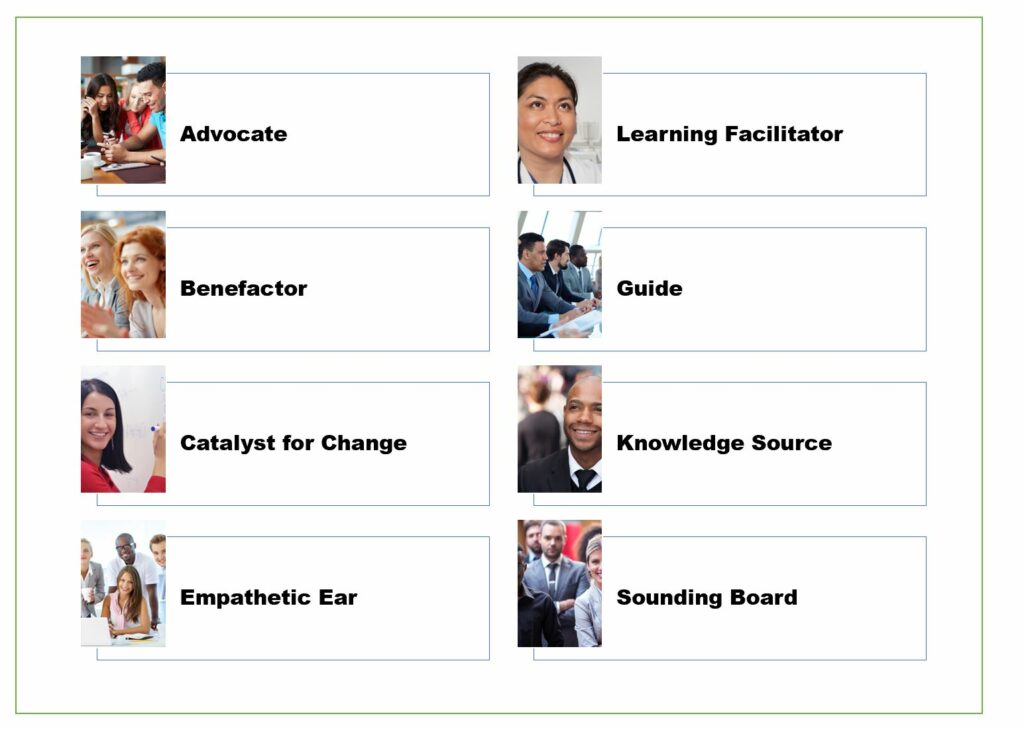

The below graphic presents the many roles that mentors undertake in working with mentees.

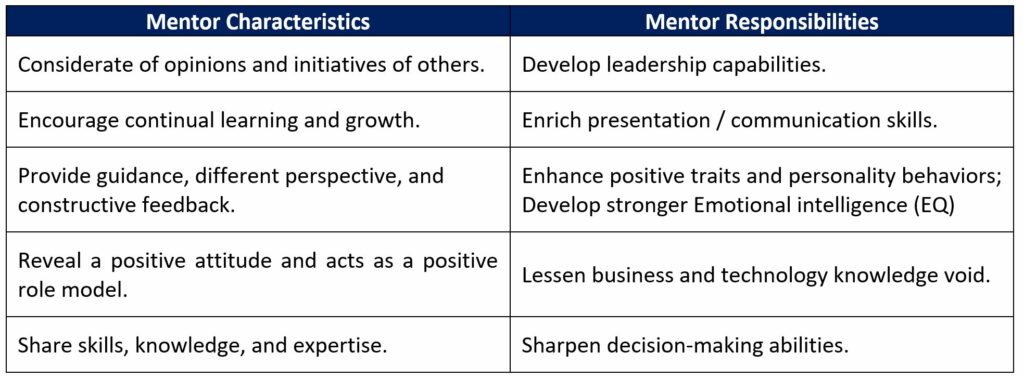

The table below outlines the prerequisite mentor characteristics and responsibilities of successful business mentors.

Highly-experienced mentors realize that building trust and empathy are crucial components of establishing a good working relationship with the founding team. Listening is an essential skill that allows the mentor to get to know the founders as people, their personal and business goals and strengths and weaknesses, their skills and competencies, and their work philosophy and habits.

Experience supports that business mentoring relationships can be significant drivers of successful business results along with enrichment of key managerial employee skills, insights, and business knowledge.

Collective market reserach revels that mentored startups grow 3.5x faster and raise 7x more money.

The use of professional mentors typically produces the following benefits for startups.

- Engage expertise at the right time.

- Reduce overall expenditures.

- Collapse timeframes.

- Streamline changing workloads.

- Grow expertise for the future.

- Leverage the professional’s gravitas.

- Avoid unnecessary and costly errors and risks.

Talented mentors possess positive personality traits they continually exhibit within highly-motivating behaviors during mentoring sessions and interactions, including:

- Emphasize listening and questioning instead of over-powering advice-giving.

- Build the mentees’ trust and confidence through two-way collaboration and supportive feedback.

- Encourage, inspire, and challenge the mentee to achieve his or her goals continually.

- Help the mentee grasp and appreciate alternative interpretations and approaches set against traditional status quo responses.

- Identify and reflect on successful strategies that mentee has used in the past that could apply to new challenges.

- Avoid the temptation to control and manipulate the mentee relationship and steer its outcomes to predetermined commitments.

- Share and relate previous business experiences, lessons learned, and insights into current mentee business events.

- Present oneself as a “learning facilitator” rather than a consultant with all the answers.

- Use verbal prods to help the mentee think and envision more broadly and deeply.

- Assist the mentee in connecting people and other resources that go beyond current experiences and wisdom on particular topics.

“Embrace what you don’t know, especially in the beginning, because what you don’t know can become your greatest asset. It ensures that you will absolutely be doing things different from everybody else.”

Sara Blakely

The Way Forward

At Knowledge Compass we bring together nearly four decades of thought leadership in business and technology strategy, the latest tools and best practices, and a seasoned consultant team with the competencies and talent to help our clients improve productivity and profitability of all enterprise business and support activities.

Knowledge Compass explores and develops valuable new insights from business, technology, and science by embracing the powerful technology of ideas and brainstorming. Our consultants engage customers in challenging discussion and experimentation to expand the boundaries of business science and practice and translate creative ideas into practical solutions from within and beyond business.

Working with Knowledge Compass means a collaborative approach to understanding your current business model, strategies, and key business requirements and goals.

Knowledge Compass provides consulting services with the use of an array of Frameworks, Analyses Tools, and Interactions from their Best Practices Consultant Toolbox.