Introduction

Technology professionals are evolving from traditional centralized IT activities into strategic roles, within focused business lines of business (LOB) structures, with direct technology-spend budget responsibilities. LOB is an organizational concept comprised of individual business units that support the creation, promotion, sales, and management of industry-centric industry sectors. Today, organizations realize that current and prospective customers are more inclined to establish long-term business relationships with providers who are genuinely invested in their particular industry sector and operate with high-value 360-service coverage.

A key challenge facing business leaders, in the current environment, is that, over the years, they have typically deprecating their IT staff in pursuit of cost reduction initiatives and profitability goals and now face a real-world demand to obtain top-level technical and business professionals that can provide value-add skills and competencies to support corporate target industry grouping customers.

Market research supports that current and future technology spending funded by functional business / LOB activities is growing faster than spending from centralized IT departments.

“Strategy is about making choices, trade-offs; it’s about deliberately choosing to be different.”

Michael Porter

Market Trends & Directions

An array of topical market research is presented below, sourced from Microsoft and IDC.

Microsoft in 2017 reported:

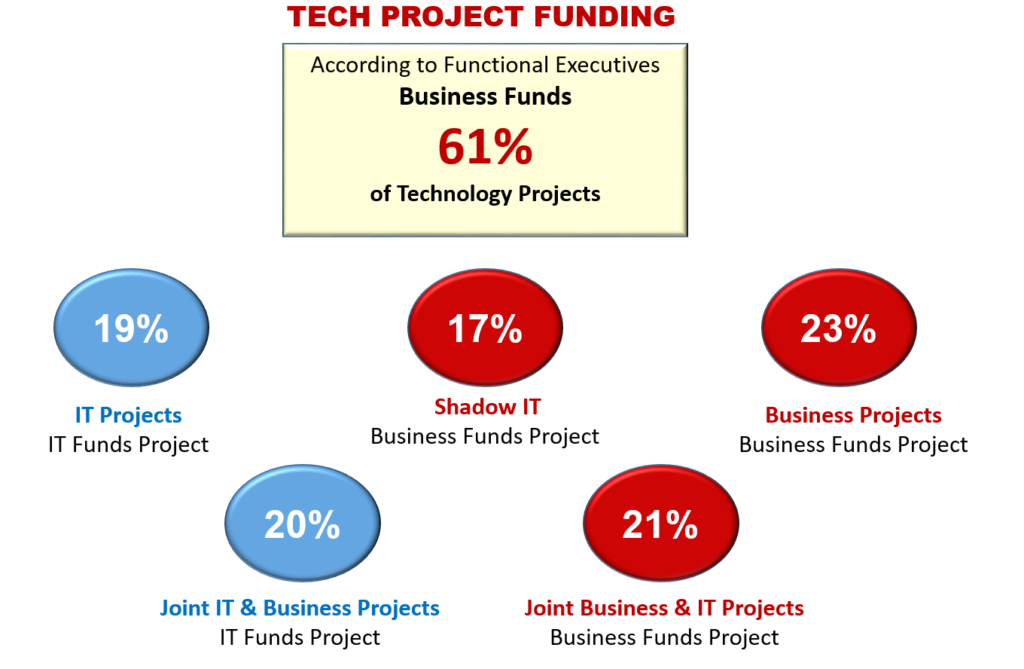

- 61% of technology projects are being managed and funded by LOBs, and LOB Business Solution providers are directly and significantly influencing 81% of software projects in the marketplace.

- Those providers that focus on business outcomes, with their customers, will more likely outperform those that rely solely on selling generic software development to corporate and public-sector IT activities.

IDC in 2017 reported:

- Corporate IT spending funded by functional business units will grow faster than spending from central IT departments in 2017.

- Worldwide technology spending by business units will increase by 5.9% to $609 billion, according to IDC, which recently updated its Worldwide Semiannual IT Spending Guide: Line of Business. The report quantifies the purchasing power of a line of business technology buyers by providing a detailed examination of where funding originates. It also predicts that LOB spending will enjoy compound annual growth of 5.9% between 2015 and 2020.

- In comparison, technology spending by central IT buyers is expected to post a five-year CAGR of just 2.3%. At those rates, IDC expects LOB spending to be nearly equal to that of the IT organization by the end of the period.

- The technology categories that will see the most spending from LOB buyers in 2017 will be applications ($150.7 billion), project-oriented services ($120.3 billion) and outsourcing ($70.3 billion). Categories earning the most spending from IT buyers will be outsourcing ($149.2 billion), project-oriented services ($82.2 billion), and training/support ($79.8 billion).

- Combined IT-LOB purchases of outsourcing and project-oriented services ($422 billion) will represent nearly one-third of all technology spending during the year. The technology categories that will see the fastest growth in spending over the full forecast period are tablets and midrange enterprise servers (14.7% combined CAGR). LOB buyers will also continue to invest aggressively in applications and application development and deployment (8.5% and 9.3% CAGRs, respectively).

- In 2017, IDC expected LOB spending to be larger than central IT spending in five industries: discrete manufacturing, healthcare, media, personal and consumer services, and securities and investment services. By 2020, this number is forecast to grow to nine with insurance, process manufacturing, professional services, and retail industries joining the ranks. LOB spending is forecast to grow faster than the IT organization in 16 sectors covered.

“Companies that grow for the sake of growth or that expand into areas outside their core business strategy often stumble. On the other hand, companies that build scale for the benefit of their customers and shareholders more often succeed over time.”

Jamie Dimon

0 Comments