Introduction

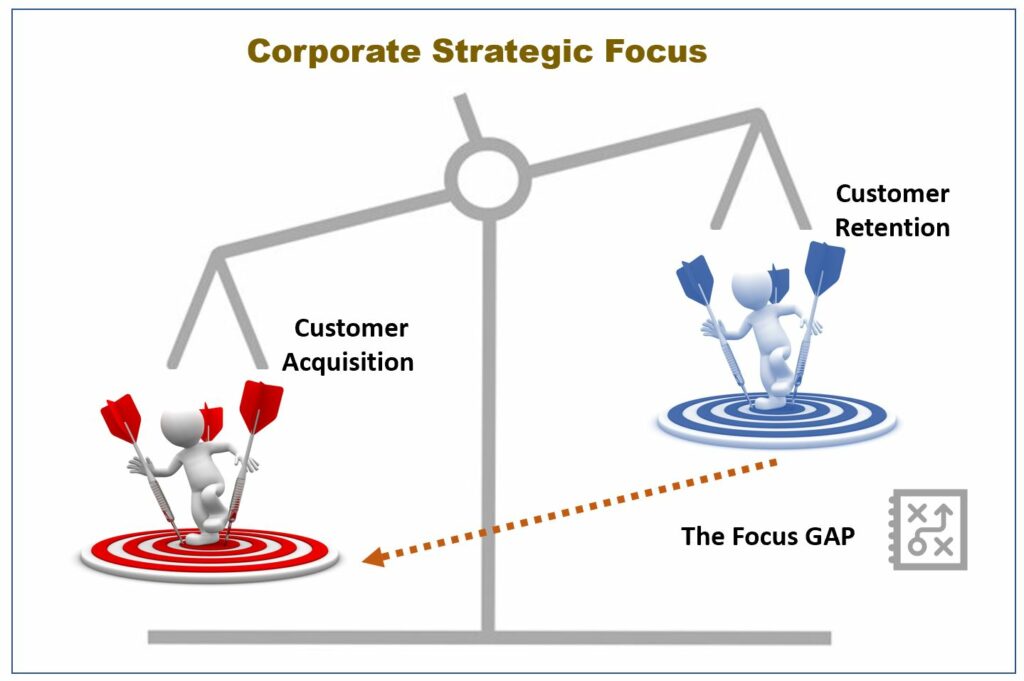

A primary strategic goal of mainstream businesses is the regular acquisition of new customers, leaving limited resources to drive customer retention successfully. Research supports the proposition that it is less expensive to maintain and continually delight existing customers than to invest disproportionate resources in winning new customers. Nonetheless, a majority of Fortune 500 companies devote more budget to winning new name customers as opposed to using a multifaceted strategy, comprising balanced customer acquisition and customer retention activities.

“Depending on which study you believe, and what industry you’re in, acquiring a new customer is anywhere from five to 25 times more expensive than retaining an existing one.”

Harvard Business Review

Today, customer expectations for quality, performance, and pricing are intensifying, driven by emerging technologies from artificial intelligence, chatbots, and virtual reality tools to enhance the shopping and product experience. Combined with increased competition from within and outside of product market segments, companies need to be both on the offensive in acquiring new name customers and defense in defending customer loss switching to competitors and instances of deadly churn.

To produce sustained and profitable growth, companies must have a clearly-defined strategy and supporting plans for not only acquiring customers but also to retain them. After all, Customer retention increases the lifetime value of customers and fosters mutually-beneficial long-term customer relationships. It is a strategic imperative to keeping customers happy and satisfied with the goals of having a meaningful impact on both the top and bottom line of the business.

Companies with difficulties in meeting revenue and profitability forecasts usually experience a Focus GAP between the resources allocated to customer acquisition and retention activities.

All customers are not the same as some provide more revenue, have different business requirements and service needs, and fewer costs than others. Businesses in the modern hyper-competitive era must identify precisely where and how to focus their sales investments and resources on maximizing profitability correctly, thereby moving the Focus GAP to a more balanced position.

The Customer Lifetime Journey (CLJ)

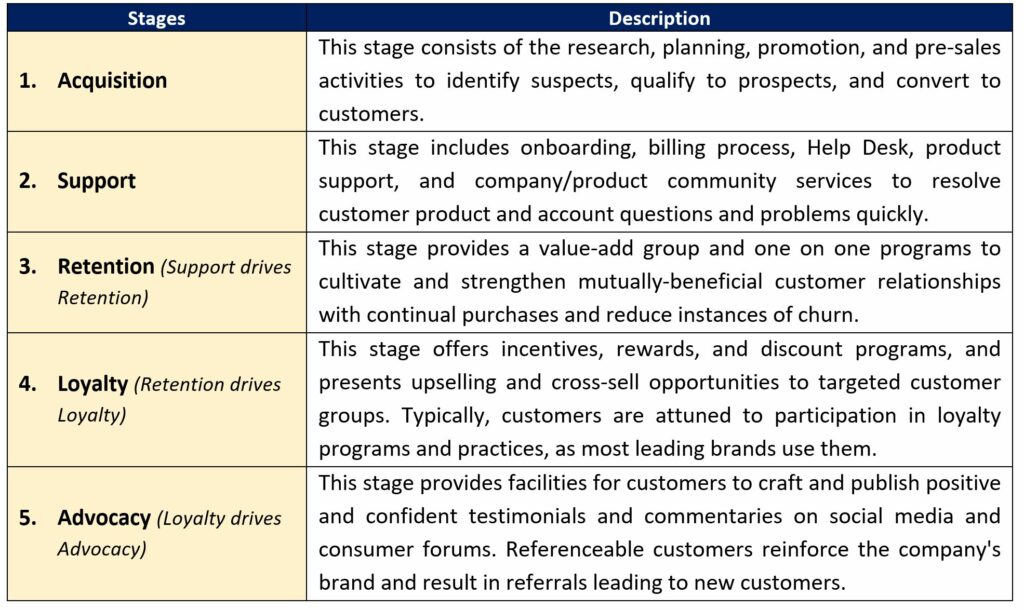

Leading industry companies understand that proactive post-acquisition customer handling is crucial to future profitability and requires the use of pragmatic customer motivating and empowering programs supported within a systematic Customer Lifetime Journey (CLJ) process.

The customer lifetime journey commences at the Acquisition Stage and progresses via dedicated interactions for the Support, Retention, Loyalty, and Advocacy Stages. The CLJ drives customer retention and reduction of churn, receipt of incremental revenue from additional purchases, upselling, and cross-sell opportunities, and new revenue sources from customer referrals.

The customer lifetime journey approach supports the proposition that highly-profitable and long-lasting customers require continual nourishment and encouragement of the stakeholders over a projected business lifecycle. The phrase ‘out of sight out of mind’ best exemplifies the notion that constant and rewarding interactions are necessary to maintain a positive and human-based relationship with continual value creation.

A description of Customer Lifetime Journey Stages follows.

Customer Lifetime Value (CLV)

The Customer Lifetime Value (CLV) is both a concept and a metric that measures the profit a customer contributes to the business over their lifetime – which starts with a new customer’s initial purchase and ends with the “Moment of Churn.” CLV, based on the present value of the projected future cash flows, provides critical input to strategic decisions.

CLV is a measurement of how valuable a customer is to a business over time. Not all customers are valued equally. Because it is less expensive to retain existing customers than acquire new ones, keeping the CLV high is essential to the success of the business. In summary, a higher CLV identifies a predominance of loyal customers.

CLV supports the Customer Lifetime Journey (CLJ), with identification of the higher-value customers for personalized targeting. It is a business management truism that the most loyal customers are also the most profitable customers. As customer loyalty increases, the probability of successful retention increases and continual sales growth is a given. Moreover, faithful customers likely spend more per order, and corporate dedicated retention programs tend to reduce churn.

CLV provides quantitative precision and a compelling insights to customer acquisition and relationships as it forecasts the value of each customer, in financial terms, and how much a company should be willing to invest in acquiring each new customer.

” We see our customers as invited guests to a party, and we are the hosts. It’s our job every day to make every important aspect of the customer experience a little bit better.”

Jeff Bezos

CLV: The Models & Formulas

There is an array of acceptable methods to calculate customer lifetime value, but the easiest involves the use of three parameters:

- Constant Margin: contribution after deducting variable costs including retention spending) per period,

- Constant retention probability per period, and

- Discount rate.

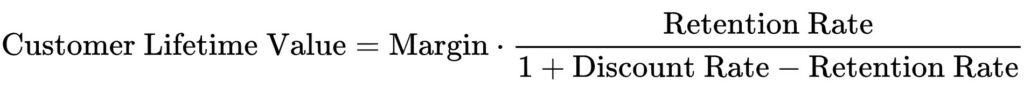

When Margins and Retention Rates are constant, the below formula can be used to calculate the lifetime value of a customer relationship:

CLV is a multiple of the Margin. The multiplicative factor denotes the Present Value of the expected length (number of periods) of the customer relationship. When Retention:

- Equals 0, the customer will never be retained, and the multiplicative factor is zero.

- Equals 1, the customer is always retained, and the firm receives the Margin in perpetuity.

The Present Value of the Margin in perpetuity turns out to be the Margin divided by the Discount Rate. For retention values in between, the CLV formula provides the appropriate multiplier.

A study by Price Intelligently showed that a 1% increase in customer acquisition affects your bottom line by about 3.3%. But improving your retention rate by 1% extends customer lifetime value and increases your bottom line by around 7%.

The Customer Lifetime Value (CLV) will determine the businesses’ sustainability and future growth that can be calculated using either the:

Historical CLV Model

The Historical CLV is the sum of the gross profit from all historic purchases for an individual customer. This CLV Model is acquired simply, and it is more accurate with use of raw numbers.

Determining the customer lifetime value based on profit reveals the actual profit a customer is generating for the business. This model considers customer service expenses: cost of returns, acquisition costs, and cost of marketing tools. The Historical Model may present problems as it can be complicated to calculate on an individual basis, mainly if the requirement is to update regularly.

Predictive CLV Model

The Predictive CLV Model is based on predictive analysis and includes previous transactions and various behavioral indicators that project the customer’s lifetime value. This Model uses algorithms that generate precise CLV while predicting a customer’s total value.

Predictive Model is more effective for analysis because it enables future planning as it relies on existing transactions and behavioral variables. Each new purchase, along with behavioral data, enhances the predictive CLV.

According to Forbes, “the power to gain revenue is from existing customers” as they will be the first to know about, buy, and recommend your new products or services. Thus, Customer Retention then, not customer acquisition, is extremely valuable to CLV.

Customer Retention: Defining the Edges

Customer retention is the rate at which the business successfully retains its paying customers over a given period and is a strategic necessity that:

- Measures the success of acquiring, delighting, and maintaining existing customers.

- Provides company profit contribution from customer lifetime value and,

- Cultivates and strengthen customer mutually-beneficial relationships.

The basis of a successful retention strategy is the ability to recognize symptoms of potential customer product or services discontent before they fully crystalize and apply favorable resolutions immediately. Quick responses generally avoid instances of churn (customer loss). Experience supports that it is an impossibility to reverse switching decisions once a customer departs to a competitor.

Since most companies generally allocate a sizable budget to acquiring new name customers, it should be a significant concern about how easily customers can switch to a competitor. An effective retention strategy is a mission-critical lever to defend against the competition by growing a business with loyal and profitable customer relationships. High customer retention means customers are satisfied and continue to buy, and do not defect to another product or competitor or non-use.

Churn, also known as customer attrition, is the inverse of customer retention and instances to avoid at all costs. Churn is the number of customers that decide not to return after one or more purchases after experiencing a negative explicit or implicit situation. A business cannot successfully grow with a high churn rate.

Salesforce reports:

“Focusing on customer retention can increase total customers by 1.5x over a period of 18-24 months, minimize customer acquisition costs by a staggering 30 percent, and increase revenue by as much as a whopping 80 percent.”

Sales Roles: Hunters and Farmers

Most people that follow sports would rate Tom Brady as one of the best quarterbacks of all time. However, it is doubtful that this same group of people would consider Tom ready and able to pitch the opening game of the MLB World Series.

Then why are many businesses unable to distinguish between the personality types and skills required for different sales roles and continually make flawed decisions on sales team selection and employment? The response of most sales leaders to this perplexing situation includes environments with legacy and outdated sales policies, embedded sacred cows, ineffective recruiting and hiring processes, lack of proper business analysis, and weak sales leadership.

It is a recognized best practice for marketing and sales executives to continually assess the personality characteristics and suitability requirements for their different corporate sales roles. These crucial insights support the successful formation and constant refreshment of sales teams with the correct traits, qualities, and skills in ensuring the effectiveness of the corporate sales programs.

For example, an essential component of the Customer Lifetime Journey (CLJ) is the sales roles, requiring both the Hunter and Farmer, as described below.

Sales Hunters (Aquisition Stage)

Hunters are highly independent, extremely passionate, self-driven, and generate sales energy through aggressive “hunting” of new prospects. Hunters are solution-oriented and focused on solving customer problems, exploiting new opportunities, and creating value for their customers.

Sales Farmers (Retention Stage)

Farmers are specialists at servicing the existing customer base, and in contrast to Hunters, more focused on developing long-term relationships. Farmers keep current customers loyal, drive continual purchases, and present suitable cross-sell and upsell opportunities as required. Generally speaking, Farmers are akin to the Account Manager type of personality.

“There is only one boss. The customer. And he can fire everybody in the company from the chairman on down, simply by spending his money somewhere else.”

Sam Walton

The Way Forward

At Knowledge Compass we bring together nearly four decades of thought leadership in business and technology strategy, the latest tools and best practices, and a seasoned consultant team with the competencies and talent to help our clients improve productivity and profitability of all enterprise business and support activities.

Knowledge Compass explores and develops valuable new insights from business, technology, and science by embracing the powerful technology of ideas and brainstorming. Our consultants engage customers in challenging discussion and experimentation to expand the boundaries of business science and practice and translate creative ideas into practical solutions from within and beyond business.

Working with Knowledge Compass means a collaborative approach to understanding your current business model, strategies, and key business requirements and goals.

Knowledge Compass provides consulting services with the use of an array of Frameworks, Analyses Tools, and Interactions from their Best Practices Consultant Toolbox.